About the right to social security and human rights

Content

Retirement benefit amounts depend upon the average of the person’s highest 35 years of “adjusted” or “indexed” earnings. A person’s payroll-taxable earnings from earlier years are adjusted for economy-wide wage growth, using the national average wage index , and then averaged. If the worker has fewer than 35 years of covered earnings these non-contributory years are assigned zero earnings. The sum of the highest 35 years of adjusted or indexed earnings divided by 420 produces a person’s Average Indexed Monthly Earnings or AIME. In the past, legislation has been enacted to prevent trust fund depletion.

Investopedia does not include all offers available in the marketplace. With the aging of the U.S. population, some observers have raised concerns about the viability of a system in which fewer active workers will be supporting greater numbers of retirees.

Program Contact Information

A rise in your income if you are a Medicare beneficiary — whether due to the COLA, earnings from employment, retirement savings, or pensions —could also impact what you’ll pay in Medicare premiums. If your income is higher than $97,000 or $194,000 , you will see an increase in Part B and Part D premiums. The World Bank is a strong partner of the Global Partnership for Universal Social Protection under the co-leadership of the World Bank and the International Labour Organization. USP2030 partners work together to increase the number of countries that provide USP by supporting governments in designing and implementing universal and sustainable social protection systems. Social protection aims to achieve this by increasing people’s resilience, equity, and opportunity, the three goals of social protection, by means of a range of instruments in the social insurance, labor and economic inclusion, and social assistance and care domains. This set of interventions is collectively referred to in the Compass as social protection.

Though it is best known for retirement benefits, it also provides survivor benefits and income for workers who become disabled. Originally the benefits received by retirees were not taxed as income. In 1984, the portion of the benefits potentially subject to tax was 50%. Moreover, since the taxable income threshold is not indexed to inflation, the portion of beneficiaries’ social security payments subject to income tax has risen significantly in real terms since the threshold was set in 1984.

If You’re Not Sure Why You Received a Payment

For disabled workers, the monthly average was $1,483.10 ($17,797.20 annually). Spouses of disabled workers received an average of $408.42 monthly ($4,901.04 annually), and children of disabled workers got $470.77 monthly ($5,649.24 annually). While inflation-adjusted stock market values generally rose from 1978 to 1997, from 1998 through 2007 they were higher than in March 2013.

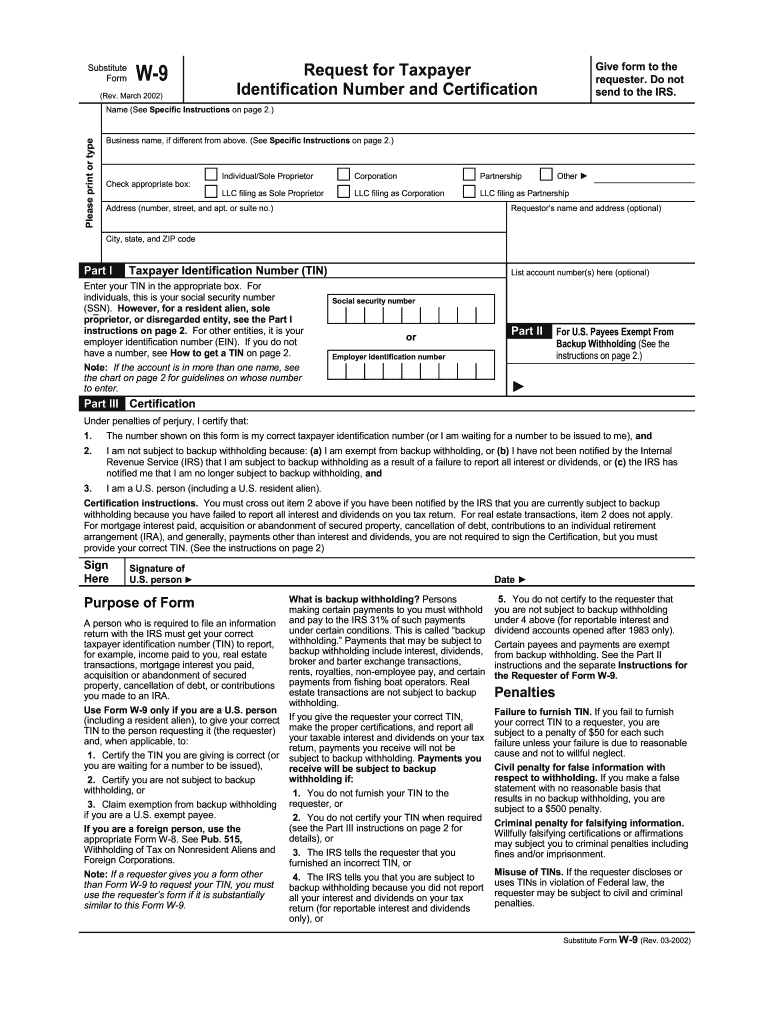

The purposes for which obligations of the United States may be is- sued under the Second Liberty Bond Act, as amended, are hereby extended to authorize the issuance at par of special obligations exclusively to the Fund. Obligations other than such special obligations may be acquired for the Fund only on such terms as to provide an investment yield not less than the yield which would be required in the case of special obligations if issued to the Fund upon the date of such acquisition. For the purposes of the income tax imposed by Title I of the Revenue Act of 1934 or by any Act of Congress in substitution therefor, the tax imposed by section 801 shall not be allowed as a deduction to the taxpayer in computing his net income for the year in which such tax is deducted from his wages. The term aid to dependent children means money payments with respect to a dependent child or dependent children. Provide that the State agency will make such reports, in such form and containing such information, as the Board may from time to time require, and comply with such provisions as the Board may from time to time find necessary to assure the correctness and verification of such reports. If you file a federal tax return as an individual and your combined income – your adjusted gross income, plus nontaxable interest earned on investments, plus one-half of your Social Security benefits – is between $25,000 and $34,000, you may have to pay income tax on up to 50% of your benefits. If you earn more than $34,000, up to 85% of your benefits may be taxable.

Things to Know About Social Security and Taxes

If you are already receiving SSA benefits payments, there will be no change in the method of distribution of those payments. If you received payment by electronic funds transfer , or direct deposit, follow the directions under Find Information About a Payment. Report your lost, missing, or stolen federal checkto the agency that issued the payment. If your documentation indicates it’s a different agency, and you need its contact information, look in the A-Z Index of U.S.

How Sweden Saved Social Security – WSJ – The Wall Street Journal

How Sweden Saved Social Security – WSJ.

Posted: Wed, 22 Feb 2023 17:54:00 GMT [source]

If the worker earned delayed retirement credits by waiting to start benefits after their full retirement age, the surviving spouse will have those credits applied to their benefit. If the worker died before the year of attainment of age 62, the earnings will be indexed to the year in which the surviving spouse attained age 60.

Due to changing needs or personal preferences, a person may go back to work after retiring. In this case, it is possible to get Social Security retirement or survivors benefits and work at the same time. A worker who is of full retirement age or older may keep all benefits, after taxes, regardless of earnings.

However, they caution that the results are just estimates as they can’t The Social Security the actual benefit amount until you apply for benefits. Reasons as to why the actual benefit amount may end up differing from the estimate are provided. At the request of the taxpayer the time for payment of the tax or any installment thereof may be extended under regulations prescribed by the Commissioner with the approval of the Secretary of the Treasury, for a period not to exceed six months from the last day of the period prescribed for the payment of the tax or any installment thereof. The amount of the tax in respect of which any extension is granted shall be paid (with interest at the rate of one-half of 1 per centum per month) on or before the date of the expiration of the period of the extension. Upon receipt of such certification, the Secretary of the Treasury shall, through the Division of Disbursement of the Treasury Department and prior to audit or settlement by the General Accounting Office, pay in accordance with such certification. Provide for cooperation with medical, health, nursing, and welfare groups and organizations and with any agency in such State charged with administering State laws providing for vocational rehabilitation of physically handicapped children.

For example, if a https://intuit-payroll.org/ was receiving benefits of $1,230/month or $14,760 a year and have an income of $29,520/year above the $15,120 limit ($44,640/year) that person would lose all ($14,760) of your benefits. If a person made $1,000 more than $15,200/year they would “only lose” $500 in benefits. People got no benefits for the months they worked until the $1 deduction for $2 income “squeeze” is satisfied. First social security checks are delayed for several months – the first check may be only a fraction of the “full” amount. The benefit deductions change in the year a person reaches full retirement age and are still working – Social Security deducts only one dollar in benefits for every three a person earns above $40,080 in 2013 for that year and has no deduction thereafter. Workers in Social Security covered employment pay FICA or SECA taxes and earn quarters of coverage if earnings are above minimum amounts specified in the law. Workers with 40 quarters of coverage are “fully insured” and eligible for retirement benefits.

- For example, a full monthly benefit amount is paid to disabled workers regardless of the age at which benefits start.

- A spouse is eligible after a one-year duration of marriage requirement is met and a divorced spouse is eligible for spousal benefits if the marriage lasted for at least ten years and the person applying is not currently married.

- The Secretary of the Treasury shall include in his annual report to Congress a full account of the administration of this title.

- In the book Democrats and Republicans – Rhetoric and Reality Joseph Fried used the calculator to create graphical depictions of the estimated net benefits of men and women who were at different wage levels, single and married (with stay-at-home spouses), and retiring in different years.